What is car leasing? A guide to Personal Contract Hire

Back to 'Expert guides'Car leasing is an increasingly popular form of financing a new car. When most people refer to the term ‘car leasing’ they are actually talking about Personal Contract Hire (PCH). This guide will explain what it means and how it works.

What is Personal Contract Hire?

With a PCH agreement you take control of a car for a contractual period, usually referred to as the ‘lease period’. Though the car is in your possession, it is not actually yours to own. Instead, you make fixed monthly payments to a leasing company for the duration of the contract.

When the contract expires you simply return the car to the leasing company or take out a new lease. As a result you never have to worry about resale values of the car. You never own it, so you can simply return the keys and walk away.

Few assets depreciate at the speed of a new car. Theoretically, it starts losing value the moment you turn on the ignition and drive away. This is where leasing, or Personal Contract Hire (PCH), comes in handy.

“If it appreciates buy it, if it depreciates lease it,” is a phrase US oil tycoon J. Paul Getty is credited with coining.

How does car leasing work?

PCH (otherwise known as leasing) is effectively a long-term car rental. Many people think it’s only available to businesses, but it’s not.

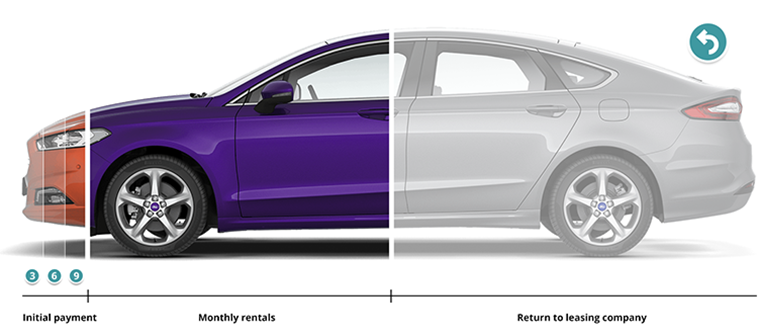

With a lease agreement you effectively agree to hire a vehicle for a set period of time based on a pre-agreed annual mileage. There is an initial rental (usually three, six or nine times the monthly rental), followed by monthly rentals spread over the length of the agreement. The more you put down up front, the cheaper the monthly payments will be, and vice versa.

It’s important to understand how your payments are determined. The leasing company will work out the ‘residual value’ of the vehicle – that is its value at the end of the contractual period once depreciation is taken into account. This is why the company will ask you to stick to a strict mileage limit while you drive the car. Read our full depreciation guide here.

To determine your payments, the company will deduct the estimated residual value from the retail price of the car, leaving you pay the difference in monthly instalments. At the end of the contract, you simply return the vehicle in an agreed state with an agreed mileage.

What’s a rental profile?

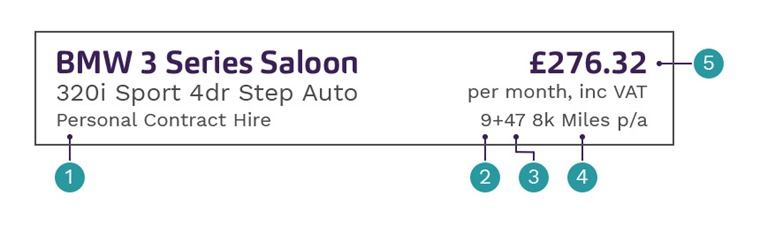

When you’re searching for a lease deal, they’ll usually look something like the picture below. Here’s a breakdown of what it all means.

1. Monthly price: The fixed monthly rental price.

2. Initial payment: A non-refundable, upfront initial payment equivalent to one, three, six or nine monthly payments. This is made in the first month of the contract, usually after you’ve taken delivery of the car. A larger initial payment (say nine months) will make the subsequent monthly payments lower, or you can pay less upfront and a little more per month. Other charges may apply, including a one-off document processing fee.

3. Contract length: The length of the contract, which is typically two, three or four years. This usually shows as the total number monthly payments, minus the first initial payment (see above). So, 23 months, 35 months, and 47 months etc.

4. Annual mileage: The average annual mileage allowance over the course of the contract. An 8,000 mileage allowance over four years, equates to a total of 32,000 miles. Extra charges of a few pence per mile will usually apply if this mileage allowance is exceeded to cover the cost in the reduced value of the vehicle. These charges will be clearly stated in the agreement. Read our annual mileage guide here.

5. Type of contract hire (personal or business): Personal contract hire should always be displayed including VAT.

Who is car leasing right for?

If you run a business, you should investigate business contract hire as this will include VAT built into monthly payments and additional incentives such as hire rental tax allowances.

For individuals, however, car leasing can be ideal depending on your circumstances – just think about how you plan to use the vehicle.

If you travel a lot and your mileage is high, the residual value of the car will drop, increasing your monthly payments. However, car leasing gives you fixed monthly payments and you have the option to drive a new car every few years, which is an excellent incentive. So as long as you don’t mind not taking ownership of a vehicle, personal contract hire could be the right solution for you.

If you have any more questions, please visit our expert guides to leasing.