Updated: Leasing vs PCP real-life examples

Back to 'Expert guides'If you like driving a new car every few years, you’ll have heard of personal contract purchase (PCP). In fact you may even be in a PCP agreement right now. It’s the most popular form of finance in the UK after all.

But have you ever considered how much you could be saving if you leased instead?

Why is leasing cheaper than PCP?

You might think we’re biased, but the way leasing works means that upfront, monthly and total costs are usually much less than for equivalent PCP deals. But how?

Well by leasing, you are paying to drive the car over a certain period rather than own it outright. This means that the costs are mainly based on the car’s expected depreciation during the lease period rather than the car’s value when it’s brand-new. This reduces costs on all fronts; upfront payments, monthly prices and the total cost is lower than taking out a PCP.

Also a PCP deal includes what is known as an “optional final payment” or “balloon payment”. This is usually around a third of the overall cost of the finance. You can either buy the car outright, or hand it back and take out a new finance deal.

Because this final payment is often thousands of pounds, the reality is most people will choose to do the latter and use the value of their car as a trade in. After all a car is a depreciating asset, and by the time it is three or four years old, most people will already be eyeing up their next shiny new one unless, of course you would prefer to lease an already-depreciated vehicle in which case, you could view our used lease deals to explore the market of cheaper, used car leasing.

So let’s be clear: Unless you want to own your car outright in a few years by paying the balloon payment, you’ll save money and have more flexibility if you lease instead.

Leasing vs PCP: Real-world examples

To show you what we mean, we’ve lined up a few real-world examples. We know prices change all the time, but the figures you see below will give you an overall idea of the big savings on offer when customer deposits and monthly payments are taken into account.

We found some leasing plans on a few popular models available right now on Leasing.com via some of our partners. Then we calculated some PCP costs using the configurators available on manufacturer websites. This allowed us to compare like-for-like models. We primarily focused on monthly costs and upfront deposits – there will obviously be some additional costings we’ve not taken into account.

We then looked at the overall costs (excluding the large balloon payment for PCP). This allowed us to calculate an estimated saving if you leased. The differences might surprise you, and are proof enough that for those that take out a PCP finance agreement and choose not to pay the balloon payment, leasing is truly the better option and could save them thousands.

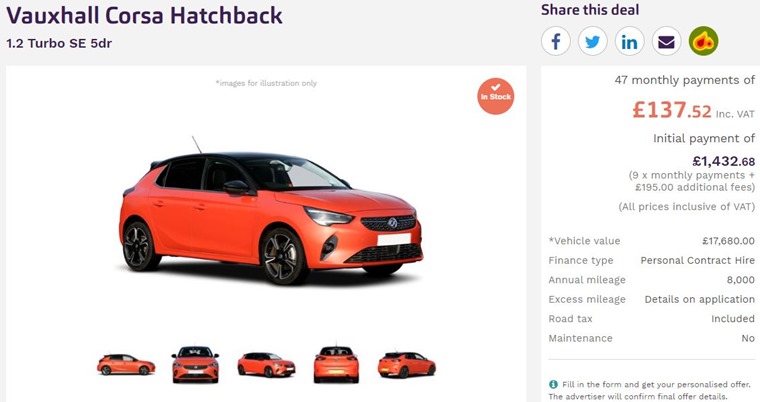

The supermini: Vauxhall Corsa – Save £3,762.92

The Vauxhall Corsa is one of the most popular cars currently available thanks to its smart new look, impressive standard equipment list and tempting monthly payments. That last point is particularly true if you lease.

The Vauxhall Corsa is one of the most popular cars currently available thanks to its smart new look, impressive standard equipment list and tempting monthly payments. That last point is particularly true if you lease.

To the right you’ll see a PCP deal we found on Vauxhall’s finance site. For £189 per month you could bag yourself a brand-new Corsa SE with the 1.2-litre petrol engine over a period of four years. They will even get a deposit contribution of £1,200 – nice touch. But that still leaves the customer to pay £2,776.04 up front followed by 47 payments of £189.

Let’s now look at a comparable deal on Leasing.com. We made sure the mileage allowance was the same as Vauxhall’s finance offer and set about finding a good deal from one of our partners. We quickly succeeded. Over the same agreement period, leasing the same car will cut your bills by more than £50 per month. And almost halve that initial upfront payment. It’s a no brainer really if you’ll be trading it in after four years anyway.

| Vauxhall Corsa SE 1.2 75PS | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £137.52 | £189 |

| Upfront costs | £1,432.68 initial rental (9 months) | £2,776.04 (Customer deposit) |

| Term of agreement | 48 months | 48 months |

| Annual mileage agreement | 8,000 miles | 8,000 miles |

| Total cost | £7,896.12 (including additional fees) | £11,659.04 (excluding optional final payment) |

Leasing a Vauxhall Corsa could save you £3,762.92.

Compare Vauxhall Corsa leasing deals now

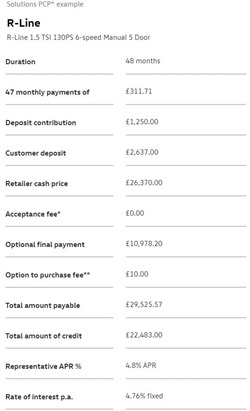

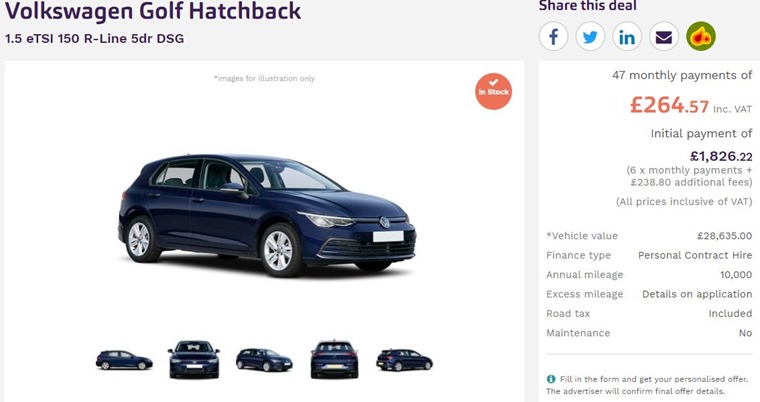

The hatchback: Volkswagen Golf – Save £3,026.36

The Volkswagen Golf has been at the top of the leasing charts for a long time. Its unshakeable popularity isn’t just limited to the PCH market though – it’s a popular choice regardless of the type of finance you’re looking to use.

The Volkswagen Golf has been at the top of the leasing charts for a long time. Its unshakeable popularity isn’t just limited to the PCH market though – it’s a popular choice regardless of the type of finance you’re looking to use.

To the right you’ll find an example of a Volkswagen PCP deal advertised on their site. With a representative APR of 4.8%, you’ll pay £311.71 over four years – plus a £2,637 upfront deposit. As with all these examples, we’ll discount that hefty £10,978.20 optional final payment, which brings the total of upfront and monthly costs to £17,287.37.

The deal is for a well-specced R-Line model featuring the 130hp 1.5-litre petrol engine. We used Leasing.com’s search function to find a comparable car and found an in-stock deal. We made sure it was also a four-year deal and that the upfront initial payment would be as close to the PCP plan as possible. The result? Monthly payments of less than £270 and around £400 less up front. That’s a saving of £3,026.36 over the term of the agreement.

| Volkswagen Golf R-Line 1.5 eTSI | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £264.57 | £311.71 |

| Upfront costs | £1,826.22 initial payment (6 months) | £2,637 (Customer deposit) |

| Term of agreement | 48 months | 48 months |

| Annual mileage agreement | 8,000 miles | 8,000 miles |

| Total cost | £14,261.01 (including additional fees) | £17,287.37 (excluding optional final payment) |

Leasing a Volkswagen Golf could save you £3,026.36.

Compare Volkswagen Golf leasing deals now

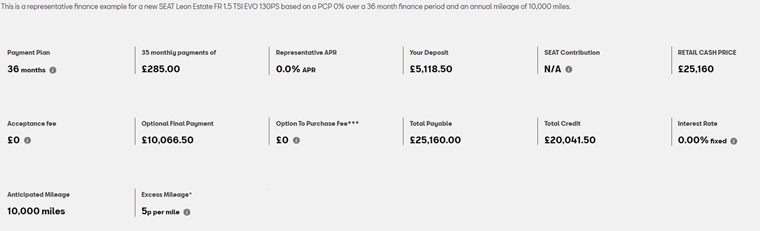

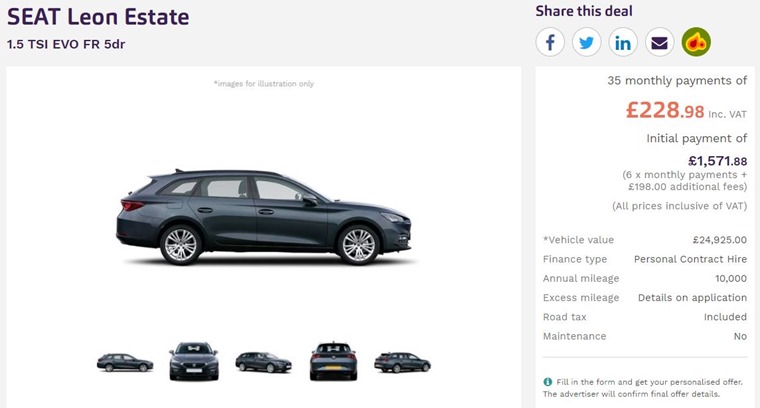

The estate: Seat Leon – Save £5,507.61

And now for another extremely popular car – for PCP and leasing customers alike: The Seat Leon Estate. We found a representative PCP deal on their site and, with no deposit contribution, upfront costs come to £5.118.50. It’s a three-year deal too, with 35 payments of £285 to be made after you’ve stumped up the cash.

Ensuring we used the same specification and mileage agreement, we jumped on our site and yet again came up trumps. A much-reduced £1.571.88 initial payment, and 35 monthly payments of £228.98. Unless you are planning to keep your practical estate a long time by paying that £10,066,50, this means leasing could save you a staggering £5,507.61 over three years. Not bad at all.

| Seat Leon FR 1.5 TSI Estate | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £228.98 | £285 |

| Upfront costs | £1,571.99 initial rental (6 months) | £5,118.50 (Customer deposit) |

| Term of agreement | 36 months | 36 months |

| Annual mileage agreement | 10,000 miles | 10,000 miles |

| Total cost | £9,586.29 (including additional fees) | £15,093.50 (excluding optional final payment) |

Leasing a Seat Leon Estate could save you £5,507.61.

Compare Seat Leon Estate leasing deals now

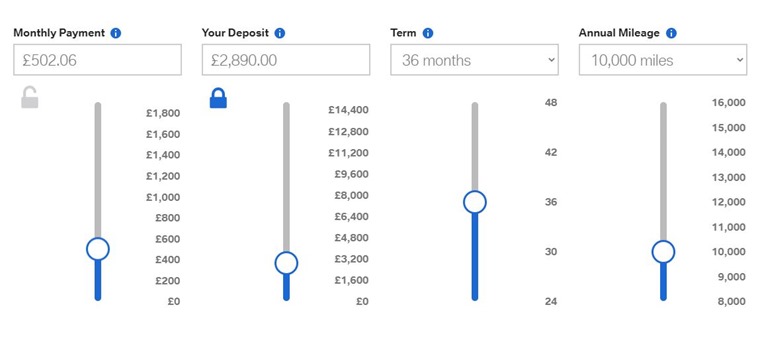

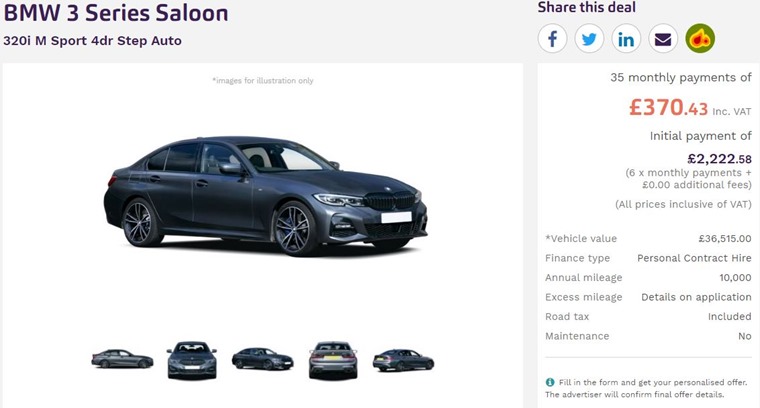

The premium saloon: BMW 3 Series – Save £5,274.47

BMW’s finance site works a little differently, so we couldn’t find a representative example being advertised at the time. However, there is a calculator that allows you to create a representative PCP example. For this, we chose the premium BMW 320i M Sport. We found that over a three-year term of 10,000 miles per annum, it’d cost you more than £500 per month to have one of these on your drive. So what about leasing plans?

Using the same mileage profile and again opting for the classy M Sport model, monthly payments were reduced to £370.43 and the initial payment fell too. You’ll often find you get some great leasing deals on more premium cars. It’s because when they’re on the Approved Used lot in a few years, they’ll still be quite pricey thanks to low depreciation.

| BMW 3 Series 320i M Sport | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £370.43 | £502.06 |

| Upfront costs | £2,222.58 initial rental (6 months) | £2,890 (Customer deposit) |

| Term of agreement | 36 months | 36 months |

| Annual mileage agreement | 10,000 miles | 10,000 miles |

| Total cost | £15,187.63 (including additional fees) | £20,462.10 (excluding optional final payment) |

Leasing a BMW 3 Series could save you £5,274.47.

Compare BMW 3 Series leasing deals now

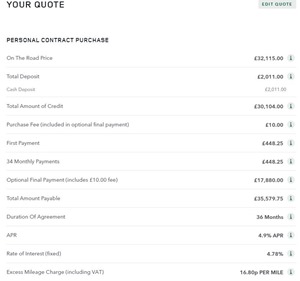

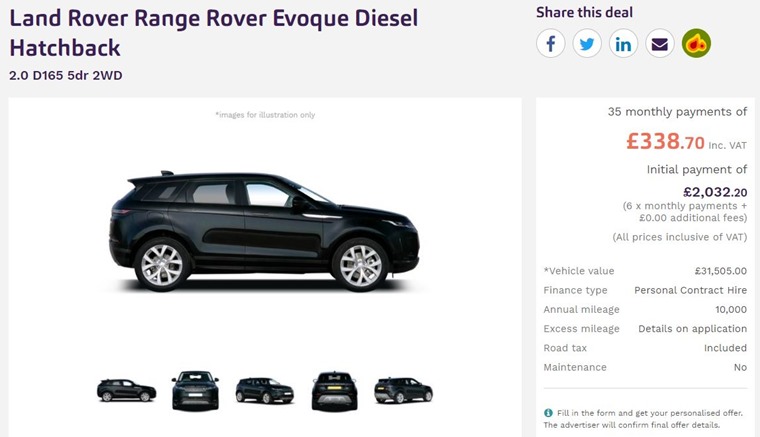

The crossover: Range Rover Evoque – Save £3,783.05

The Range Rover Evoque is another great example of how leasing can save you some cash if you want a premium car. This classy and capable vehicle has been consistently popular with leasing customers.

If you wanted to take out a PCP plan, however, we’ve found an example on Range Rover’s finance site. You’ll pay £448.25 per month over three years, while the deposit is a relatively affordable £2,011. But what if we try  and find a like-for-like model on Leasing.com? What would the difference be? Quite significant as it turns out.

and find a like-for-like model on Leasing.com? What would the difference be? Quite significant as it turns out.

Speccing the 2.0 D165 5dr model (the same as the PCP plan), we found a great deal. The six-month initial rental might come to around £20 more than Range Rover’s customer deposit, but the lower £338.70 monthly payment more than makes up for it – to the tune of £3,783.05 over three years. Imagine what you could do with that?

| Range Rover Evoque D165 | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £338.70 | £448.25 |

| Upfront costs | £2,032.20 initial rental (6 months) | £2,011 (Customer deposit) |

| Term of agreement | 36 months | 36 months |

| Annual mileage agreement | 10,000 miles | 10,000 miles |

| Total cost | £13,886.70 (including additional fees) | £17,669.75 (excluding optional final payment) |

Leasing a Range Rover Evoque could save you £3,783.05.

Compare Range Rover Evoque leasing deals now

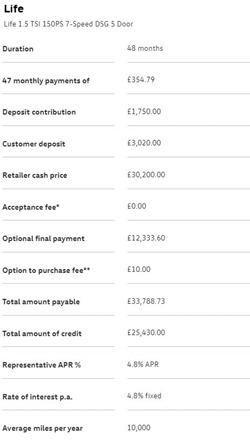

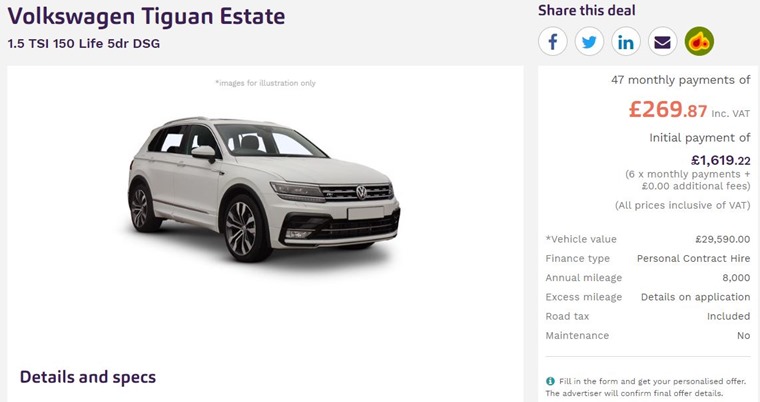

The family SUV: Volkswagen Tiguan – Save £5,392.02

Take a look at the finance offer to the right. It’s for the practical and premium Volkswagen Tiguan, one of the best SUVs in town from the reliable Volkswagen.

Take a look at the finance offer to the right. It’s for the practical and premium Volkswagen Tiguan, one of the best SUVs in town from the reliable Volkswagen.

Over four years, it shows you that you’ll pay £354.79 every month and, while they do offer a nice £1,750 to your deposit, you’re still left with £3,020 to pay up front.

That’s a lot to stump up for a family vehicle, even if it is a quality product. That optional final payment of £12,333.60 is a big one too for a four-year-old car.

How does leasing compare?

An offer from one of our trusted partners slashes those monthly payments by almost £90 per month, and a six-month initial rental halves up front costs too.

With the same mileage allowance over the same period, this will save you £5,392.02. That’s quite a few family trips to Center Parcs.

| Volkswagen Tiguan 1.5 TSI Life DSG | Leasing.com partner PCH offer | Manufacturer PCP quotation |

| Monthly payment | £269.87 | £354.79 |

| Upfront costs | £1,619.22 initial rental (6 months) | £3,020 (Customer deposit) |

| Term of agreement | 48 months | 48 months |

| Annual mileage agreement | 10,000 miles | 10,000 miles |

| Total cost | £14,303.11 (including additional fees) | £19,695.13 (excluding optional final payment) |

Leasing a Volkswagen Tiguan could save you £5,392.02.

Compare Volkswagen Tiguan leasing deals now

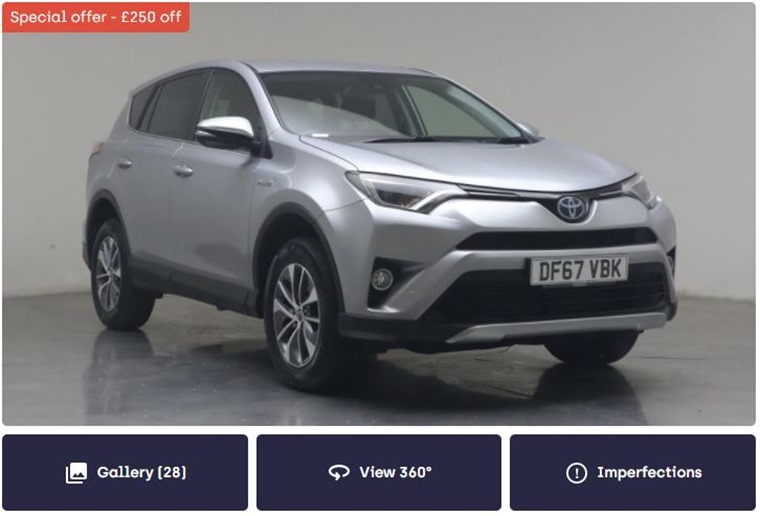

The second-hand deal: Toyota RAV4

More and more sites are offering simple ways to purchase second-hand cars online, but a quick comparison with leasing plans on our site show they might not be all their cracked up to be. We know second-hand car prices are at record highs, but the following deal is slightly outrageous in our opinion.

Take this PCP deal on a 67-plate RAV4. Despite it being the old shape, the PCP deal will cost you £398 per month. You’ll also be left with an optional final payment of £8,328 to pay after your 48 months is up. So, with the same 10,000-mile allowance, we jumped on Leasing.com to check out how much you could be saving on an all-new model.

| Toyota RAV4 2.5 Icon | Leasing.com partner PCH offer on new model | Second-hand PCP quotation (67-plate) |

| Monthly payment | £284 | £373.65 |

| Upfront costs | £1,704 initial rental (6 months) | £2,000 (Customer deposit) |

| Term of agreement | 48 months | 48 months |

| Annual mileage agreement | 10,000 miles | 10,000 miles |

| Total cost | £15,052(including additional fees) | £19,561.55 (excluding optional final payment) |

Leasing a Toyota RAV4 could save you £4,529 compared to a second-hand model

Compare Toyota RAV4 lease deals

Leasing.com keeps things simple

It’s always worth researching finance options before taking the plunge with a new car. That’s why we make it as easy as possible for you to understand the costs involved with leasing a vehicle. Remember you can find the total lease cost and sort deals by price, initial payment and value using our site.

You can read more about how leasing compares to other forms of finance in our expert guides to leasing section. Alternatively, click on the button below to start comparing leasing plans right now.