Business contract hire

Back to 'Expert guides'As the most cost-effective and easily manageable form of car leasing, business contract hire is one of the most widespread. In fact, it is the most popular way of hiring a business vehicle, with over half of all new company cars funded in this way.

What is business contract hire?

Also commonly referred to as ‘car leasing’, business contract hire is popular with various types of fleets and works in much the same way as personal contract hire, albeit exclusively for companies.

Business contract hire agreements allow a company to take on cars for a set period of time (usually between 12 months and four years) and pays via fixed monthly instalments. The company taking out the agreement doesn’t own the vehicles, however, so when the term of the contract is over, the cars are returned to the lease company.

How do you pay?

It’s important to understand how your payments are determined.

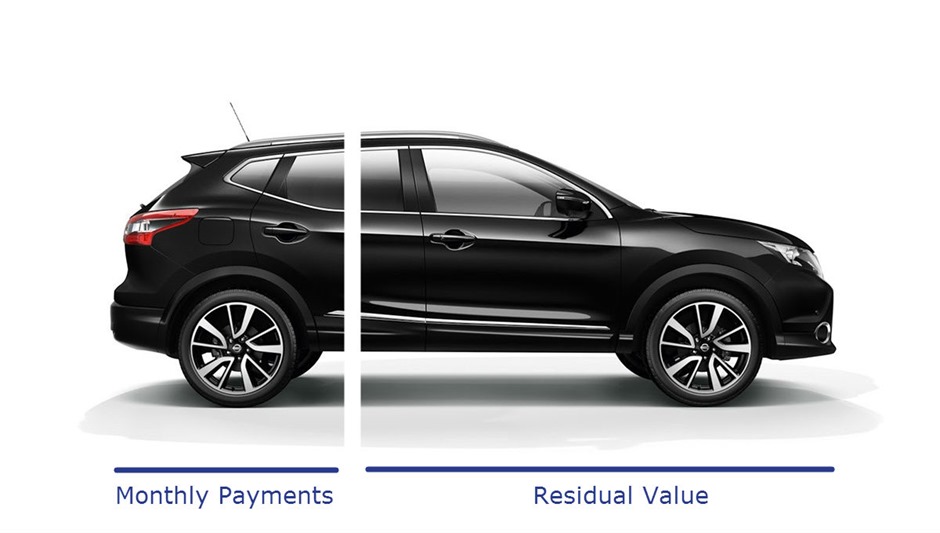

The contract hire company will work out the ‘residual value’ of the vehicle – that is its value at the end of the contractual period once depreciation is taken into account. To estimate this value, the company will ask you to stick to a strict mileage limit while you drive the car, and exceeding this limit could see you penalised at the end of the term.

To determine your payments, the company will deduct the estimated residual value from the retail price of the car, leaving you pay the difference in monthly instalments.

What are the pros of business contract hire?

There are many different pros and cons of contract hire, and what may suit one business won’t necessarily suit all, but the chief advantages include:

- Low initial payment - Unlike other forms of finance, business contract hire requires three monthly payments upfront.

- Fixed monthly costs - For a set monthly payment, your business gets the use of a vehicle for an agreed duration and mileage that suits your needs.

- Hassle free - For an additional monthly fee, you can ask your business contract hire company to take care of nearly every hassle associated with vehicle ownership, whether it is maintenance, servicing or replacement vehicles.

- Free up capital - Business contract hire is an efficient way of running a fleet of vehicles. Rather than tying capital up in depreciating vehicles the company is able to invest in other areas of the business. Vehicle leases do not have to be shown on a balance sheet, which will improve a company's liquidity ratio, gearing and return on assets.

- Flexibility - Running a fleet using business contract hire gives the company flexibility to respond to changing market conditions. Business contract hire agreements are typically between 12 and 48 months long, which allows the fleet to respond to changes to staffing requirements more efficiently than through alternative funding methods.

- Tax advantages - Some or all of the rental charge can be offset against taxable profits. This includes 50% of the VAT on contract hire payments and 100% of VAT on a maintenance packages.

- Latest green technology – Because your fleet will always comprise modern vehicles, your company could benefit from the latest fuel-saving developments in in-car technology. This flexibility can also help business’ respond to changes in their Corporate Social Responsibility (CSR) guidelines, for example switching fleet vehicles to hybrid/electric.

What are the cons to consider?

- Early termination costs: You can terminate a contract early, but it can be expensive to do so. The cost depends on how much of the contract is left to run.

- Excess mileage charges– It’s wise to have an accurate idea of the vehicle’s annual mileage requirement. If you underestimate you could face additional charges should the agreed mileage limit is exceeded. If you overestimate, you’ll be paying a higher monthly fee than you actually need to.

- No option to buy - Unlike some forms of business car finance, there is no option to buy at the end of the contract.

- Damage – If the vehicle is returned with damage beyond fair wear and tear, you may incur repair charges. However, there are established industry Fair Wear and Tear Guidelines from the British Vehicle Rental and Leasing Association (BVRLA).

What do I need to take out a business contract hire deal

Eligibility may vary depending on which company is providing the finance for the lease, but generally you must meet the following criteria:

- Be a sole trader, partnership, Ltd or PLC;

- Have trading history of at least three years with bank statement and accounts;

- Produce proof of address and proof of ID for the company director;

- Pass a credit check.

Company car vs car allowance

More and more employers are offering their staff the choice between a company car and a car allowance, which is paid into your salary and yours to spend how you see fit. Take the time to decide which is best for you. If you choose to use the money for a lease car, you need to sign up for a personal contract hire deal, not a business one. You will not have to pay Benefit In Kind on the vehicle as you would do with a company car, but you will have to pay VAT.

If you have any more questions, check out this FAQs page. You can compare millions of business car leasing deals here, and there are also a selection below.